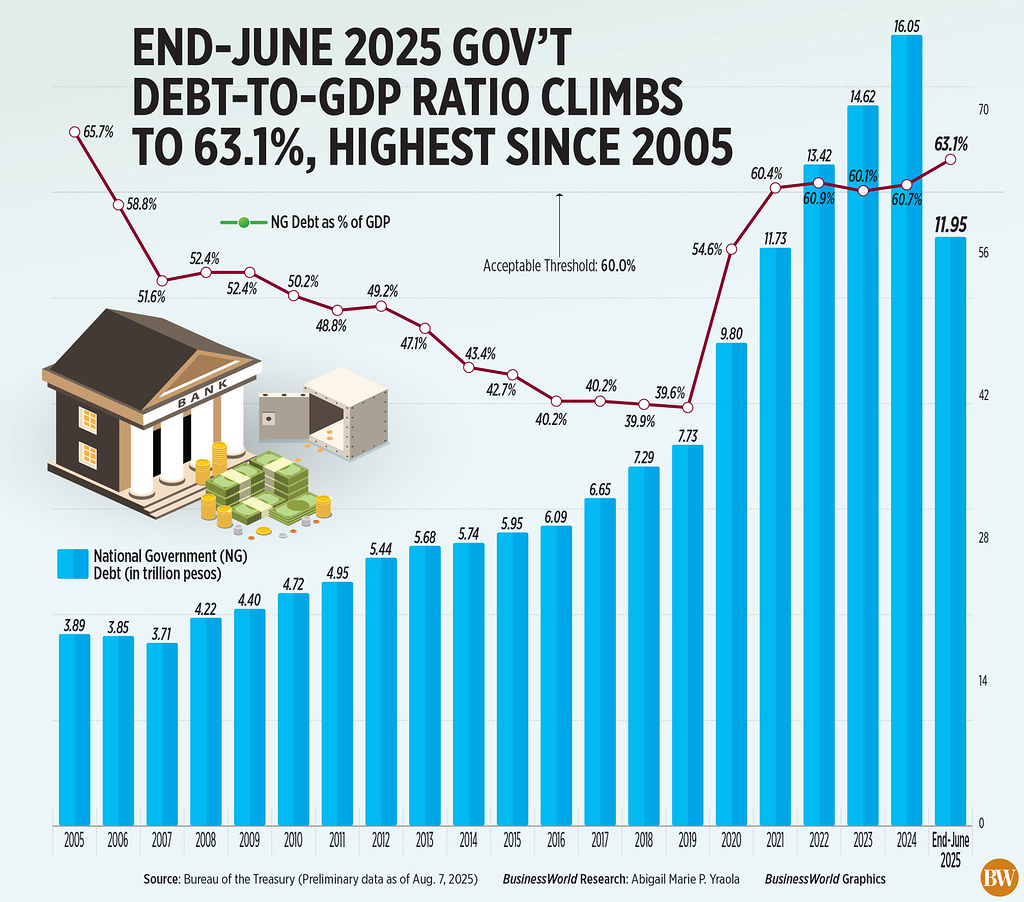

THE National Government’s (NG) debt as a share of gross domestic product (GDP) rose to 63.1% at the end of June, the highest ratio since 2005, the Bureau of the Treasury reported on Thursday.

The ratio at the end of June represented a gain on the previous quarter’s 62% and the 60.9% posted a year earlier. It is also above the 60% debt-to-GDP threshold considered by multilateral lenders to be manageable for developing economies.

The government is aiming to bring down the ratio to 60.4% by the end of 2025, and to 56.9% by 2028.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the higher debt-to-GDP was likely due to the wider budget deficit.

In the first six months, the NG budget deficit widened 24.69% to P765.5 billion.

“As well, the relatively slower GDP growth mathematically slowed the growth in the GDP denominator,” he added.

The Philippine Statistics Authority on Thursday reported GDP grew 5.5% in the three months to June, against 5.4% a quarter earlier and 6.5% a year earlier.

Mr. Ricafort cited the need for “more tax and other fiscal reform measures to increase the recurring sources of government tax revenue, ensure more disciplined government spending in an effort to narrow the budget deficit and further bring down the NG debt-to-GDP ratio.”

Palace Press Officer Clarissa A. Castro said the Department of Finance (DoF) considers 70% of GDP to be the international threshold for sustainable borrowing, as opposed to the 60% rule-of-thumb that multilateral banks often hold developing countries to.

According to the Treasury, outstanding debt jumped to a record P17.27 trillion at the end of June.

Some 69.2% of the total debt was owed to domestic creditors, while the rest was owed to foreign creditors.

Domestic debt increased 13% year on year to P11.95 trillion at the end of June.

On the other hand, external debt rose 8.3% to P5.32 trillion. The NG’s outstanding debt is projected to hit P17.35 trillion by the end of 2025.

NG gross borrowing rose 78.16% year on year to P263.99 billion in June.

Until 2027, the NG plans to source at least 80% of its borrowing program from domestic sources and 20% from foreign. — Aubrey Rose A. Inosante