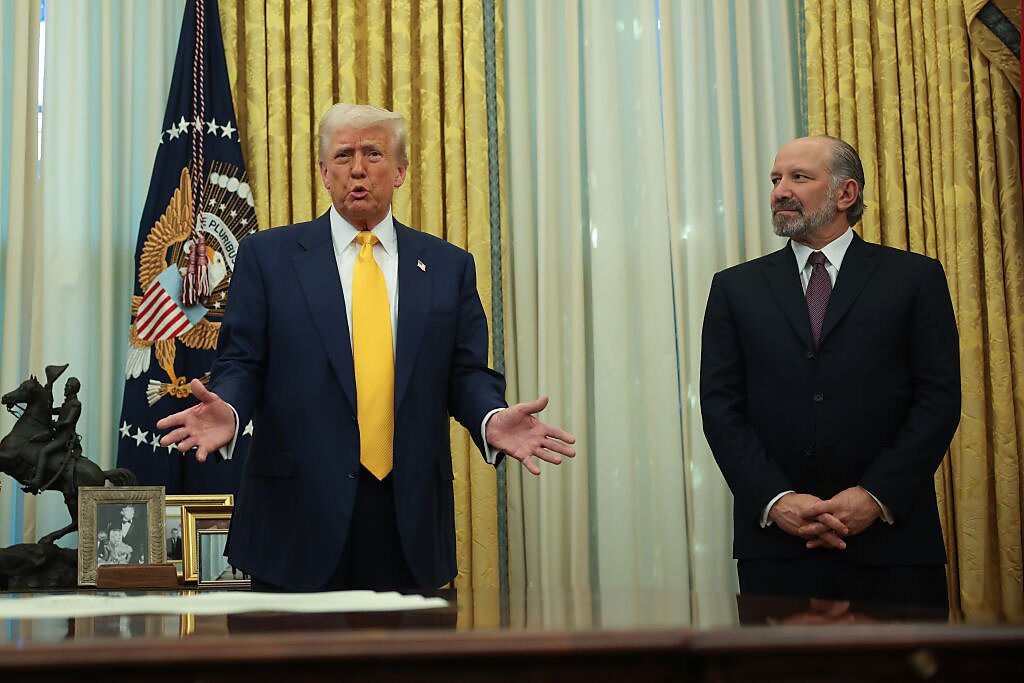

Tad DeHaven

Donald Trump’s autocratic instincts returned to the White House in January, but this time, no adults would be in the room to dissuade him from going full bore. On economic policy, an amped up tariffing agenda came as no surprise, even if the rationales and execution have been stupefying. However, it’s doubtful anyone foresaw prominent American corporations getting partially nationalized within the first six months.

In hindsight, a seed for it was planted in February when Trump signed an executive order instructing his administration to plan the establishment of a US Sovereign Wealth Fund (a bad idea), which could facilitate government ownership stakes in private companies. The order instructed Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent to submit the plan to the president within 90 days, including recommendations for funding mechanisms, investment strategies, fund structure, and a governance model.

In May, it was reported that plans were submitted to White House officials, but they weren’t satisfied with the result, so it wasn’t given to the president. “No final decisions have yet been made,” said a White House spokesman.

Unnamed sources told Bloomberg that plans for a grandiose fund “ran into legal, financial and political realities” and had become a lower priority. Ominously, sources also said Commerce and Treasury planners had sought “ways to design governance of the fund to ensure that it’s insulated from political influence,” but that “could have undercut White House ability to use the fund for Trump policy priorities.”

The White House is apparently trying to figure out other ways to satisfy the boss:

- June 13: Trump issues an executive order allowing the Nippon Steel-US Steel deal contingent on giving the government a “golden share” that enables the president to exert extensive control over US Steel’s operations.

- July 10: The Department of Defense (DoD) unveils a multi-part package with convertible preferred stock, warrants, and loan guarantees, making it the top shareholder of rare earth metals producer MP Materials.

- July 23: The White House claims an agreement with Japan to reduce the president’s so-called reciprocal tariff rate on Japanese imports comes with a $550 billion Japanese “investment fund” that Trump will control.

- July 31: Trump claims an agreement with South Korea to reduce the so-called reciprocal tariff on South Korean imports comes with a $350 billion South Korean-financed investment in projects “owned and controlled by the United States” that he will select.

- August 11: The White House confirms an “unprecedented” deal with Nvidia and AMD that allows them to sell particular chips to China in exchange for 15% of the sales.

- August 12: In a Fox Business interview, Bessent points to the alleged investments from Japan, South Korea, and the EU “to some extent” and says, “Other countries, in essence, are providing us with a sovereign wealth fund.”

- August 22: Fifteen days after calling for Intel CEO Lip-Bu Tan to resign, Trump announces that the US will take a 10% equity stake in Intel using the CHIPS Act and DoD funds, becoming Intel’s largest single shareholder.

On Monday, while discussing the equity stake in Intel, White House economic advisor Kevin Hassett told CNBC that he’s “sure that at some point there will be more transactions, if not in this industry then in other industries.” He prefaced this by noting, “The president has made it clear all the way back to the campaign, he thinks that in the end, it would be great if the US could start to build up a sovereign wealth fund.”

However, on Tuesday, Commerce Secretary Howard Lutnick told CNBC that the administration is not creating a sovereign wealth fund. Instead, Lutnick says a “national and economic security fund” will be “built” with the money the administration claims countries are “going to give us … to build our infrastructure out in America.” (Lutnick also says the administration is considering government stakes in defense contractors like Lockheed Martin.)

So, what to make of all of this?

The original executive order requested recommendations on sovereign wealth fund components (funding, structure, governance, investment rules, etc.). However, the plan was apparently jettisoned when the White House realized that a formal one would require congressional action and constraints on Trump. Hassett and Bessent still refer to a sovereign wealth fund, and Lutnick says it’s not. That would indicate that the administration’s top economic officials have been making it up as they go along.

All three continue to reference a fund, but no formal fund exists, and one cannot be created by executive order. An EO can tell agencies to coordinate deals (equity, warrants, “golden share” terms), but Congress needs to turn it into a pooled investment vehicle. Repurposing and expanding an existing structure, like the US International Development Finance Corporation, would also take new statutory authority and money. As for the money from these “deals,” by default it goes to the Treasury under the Miscellaneous Receipts rule—unless a law says otherwise.

Trump can’t just order money into a presidential fund of his own creation.

Perhaps, then, the shakedowns will remain ad hoc, and the president will be content to have a “fund” in mind. Regardless, as is typical with this administration, there are more questions than answers.